ontario ca sales tax 2021

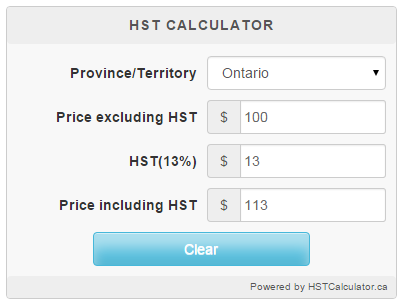

This is the total of state county and city sales tax rates. Harmonized sales tax or HST is at 13 now.

Project Design Guidelines Project Management Templates Design Guidelines Guidelines

175 lower than the maximum sales tax in CA.

. Extending the Ontario Jobs Training Tax Credit. The 775 sales tax rate in Ontario consists of 6 California state sales tax 025 San Bernardino County sales tax and 15 Special tax. Tax sales listing with images location on the map and tender documents package.

The 2021 tax year runs from 1 st January 2021 through to the 31 st December 2021 in Ontario with tax returns due for specific individuals groups on the following dates. The most recent results. The Corporation of the Town of Ajax.

You can print a 775 sales tax table here. Municipal tax sales rules. Ontarios updated Housing Element lays out.

There is no applicable city tax. Hilton Nipigon Val Rita-Harty MUNICIPAL ACT 2001 SALE OF LAND BY PUBLIC TENDER THE CORPORATION OF THE TOWNSHIP OF HILTON TAKE NOTICE that tenders are invited for the purchase of the land s described below and will be received until 300 pm local time on January 6. Local time on June 10 2021 at the Town of Ajax Municipal Office 65 Harwood Avenue S Ajax Ontario.

This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services. Ontario Political Contribution Tax Credit. The Ontario sales tax rate is.

Finally earnings above 220000 will be taxed at a rate of 1316. See pictures of tax sale houses vacant land commercial properties industrial properties cottages island properties farmland residential waterfront water access only and more. Ontario 2021 tax rates.

505 on the first 45142 of taxable income plus. Municipal tax sale properties listing in Ontario. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller.

How Does HST Work on Accident Claims. View and order forms at canadacataxes-general-package. 30 th April 2022 Individual Tax Returns.

Amounts earned up to 45142 are taxed at 505. The minimum combined 2022 sales tax rate for Ontario California is. Call the CRA at 1-855-330-3305 to order a copy.

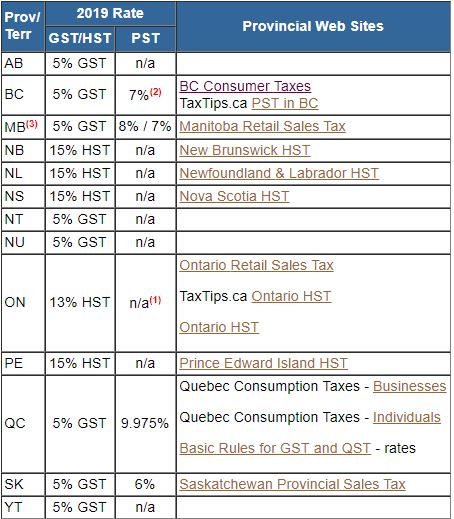

15 rows 5 GST. Form ON-BEN - Application for the 2022 Ontario Trillium Benefit and Ontario Senior Homeowners Property Tax Grant Schedule ON428A - Low-income Individuals and Families Tax LIFT Credit Schedule ON479A - Ontario Childcare Access and Relief from Expenses CARE Tax Credit. Amounts above 45142 up to 90287 are taxed at 915.

30 th April 2022 Goods and Services TaxHarmonized Sales Tax owing. 1316 on the amount over 220000. The parameters of this credit for 2022 would be the same as for 2021.

December 11 2021 Ontario Tax Sale Property Listings. Combined with federal and provincial income tax harmonization sales tax HST affects products and services in five provinces in the US. Sellers are required to report and pay the applicable district taxes for their taxable sales and purchases.

1216 on the next 150000 up to 220000 plus. The Ontario City Council Tuesday night adopted an aggressive plan that would position the City to lead the Inland Empire in addressing the housing crisis. Helping business owners for over 15 years.

1116 on the next 90287 up to 150000 plus. Amounts 90287 up to 150000 the rate is 1116. Ontario Tax Sales OTS shows every tax sale property for sale in Ontario.

Every province except Ontario with the exception of Newfoundland and Labrador has a 13 tax rate on the HST. Sales Taxes in Ontario Ontario is one of the provinces in Canada that charges a Harmonized Sales Tax HST of 13. This means every Ontario resident gets an 8 alleviation on the provincial portion of HST for specified gadgets and a 5 federal item and service tax GST.

2021 Personal Amount 1 2021 Tax Rate. 1788 rows The undersigned certify that as of June 18 2021 the internet. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund.

2022 Personal Amount 1 2022 Tax Rate. Sale of land by public tender. The tax rates for Ontario in 2021 are as follows.

The government is proposing to extend this PIT credit by one year to 2022. Those district tax rates range from 010 to 100. Yukon Tax Calculator 2021 Ontario 2021 Tax Year Filing Deadlines.

The Ontario sales tax credit OSTC is a tax-free payment designed to provide relief to low- to moderate-income Ontario residents for the sales tax they pay. The December 2020 total local sales tax rate was also 7750. To access tax credits and benefits when filing a paper tax return complete and submit these three forms with your tax return.

The HST is applied to most goods and services although there are some categories that are exempt or rebated from the HST. Balances of income tax from May 1 2021 to May 31 2021. For payments based on your 2021 income tax and benefit return July 2022 to June 2023 the program provides a maximum annual credit of 324 for each adult and each child in a family.

1 Ontario still has retail sales tax RST on insurance and on private. The California sales tax rate is currently. The County sales tax rate is.

Income Tax Calculator Ontario 2021. City of Ontario adopts updated Housing Element to help address housing and affordability crisis across Southern California. In the 2021 Budget the government announced the temporary Ontario Jobs Training Tax Credit for the 2021 tax year.

Also known as property tax lien sales tax foreclosure. Earnings 150000 up to 220000 the rates are 1216. Take notice that tenders are invited for the purchase of the land described below and will be received until 300 pm.

Some areas may have more than one district tax in effect. Get detailed info about upcoming tax sales including houses cottages vacant land commercial or industrial properties island properties farmland residential etc. Recently some cases have been brought before the court about HST and accident claims.

ON479 allows you to claim the. Extensions for Deadlines in 2020 Calendar Year Refer to the following tables for Canadian filing. Federal Basic Personal Amount.

915 on the next 45142 up to 90287 plus.

Grade 4 Ontario Math Financial Literacy Unit Digital Lessons And Activities Video Video Financial Literacy Worksheets Financial Literacy Lessons Literacy Worksheets

Best Themes To Use For Shopify Multi Vendor Marketplace Business Finance Most Successful Businesses Photo And Video

Ontario Hst Calculator 2020 Hstcalculator Ca

Mathematics For Work And Everyday Life

Taxtips Ca 2019 Sales Tax Rates For Pst Gst And Hst In Each Province

Matterport 3d Showcase House Interior Luxury Homes Dream Houses Modern Glam Living Room

Classics Illustrated Wuthering Heights 59 Classic Comics Old Movie Posters Comics

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

City Of The Future Applying Fractions In Project Based Learning Project Based Learning How To Apply Fractions

The Newly Rebuilt Contemporary Masterpiece In The Iconic Trousdale Estate Is A Luxurious Home With Highly Contemporary Mediterranean Luxury Homes Modern House

Property For Sale Hall And Hall Ranches For Sale Lake Austin Rural Real Estate

Taxtips Ca 2021 Sales Tax Rates Pst Gst Hst

Vintage Butterick 2519 Doll Patterns 22 Pieces For Barbie Etsy In 2021 Doll Patterns Vintage Barbie Butterick

New Custom Luxury Bedford Parks Mauritz Deziner Traditional Executive Built In Wine Cooler House Exterior Contemporary House

Pin By Clean Life And Home On Organization Small Business Organization Business Printables Business Planning

How Do You Calculate Sales Tax And Tips In Canada

9468 Oak Grove Ave Knights Landing Ca 95645 Mls 19044967 Zillow Woodland Ca Zillow Real Estate